Identity verification is no longer just for banks. Businesses of all kinds are now leveraging identity verification practices to build trust, mitigate risk, and comply with regulations. In this post, we’ll cover the evolution of Know Your Customer (KYC) requirements into mainstream identity verification, the essential components of effective verification, and how Enformion’s solutions can help implement these processes securely and efficiently.

What is KYC?

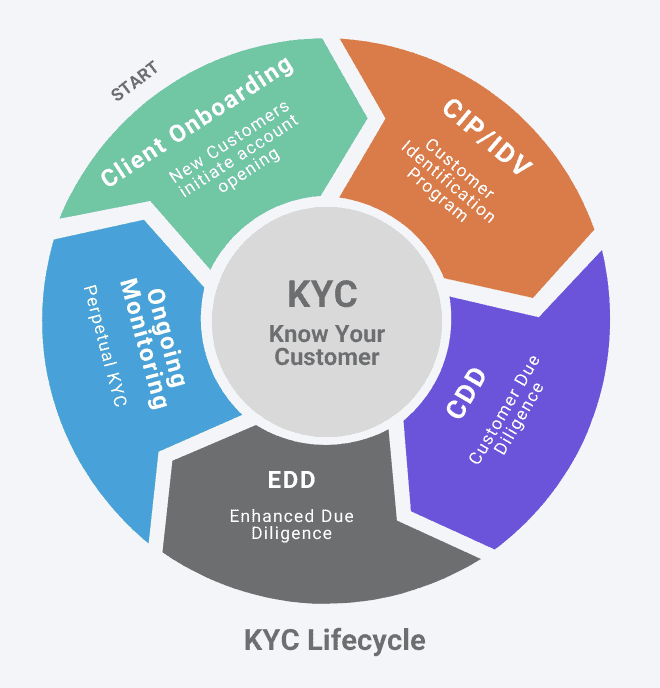

Know Your Customer, or KYC, refers to the essential measures taken by financial institutions and businesses to verify the identities of their customers and assess any potential risks associated with conducting business with them. KYC is a critical process that aims to protect businesses from the risks of financial crimes, including money laundering, terrorist financing, and fraud. Additionally, KYC practices play a pivotal role in maintaining regulatory compliance, as they help businesses adhere to anti-money laundering (AML) laws and other relevant regulations.

What are KYC Practices?

Incorrect data analysis can easily become the basis for false positives with identity verification and fraud detection. On the other hand, correct and effective data analysis techniques are often the formula for catching sophisticated fraudsters. Firms with enough experience in the industry recognize the risk that fraudsters pose – working with the right data partner allows them to stay ahead of fraud and identity thieves, particularly online.

KYC practices encompass two fundamental components: Customer Identification Program (CIP) and Customer Due Diligence (CDD).

CIP serves as the initial step in the KYC process. It requires individuals engaging in financial transactions to verify their identities, reducing the risk of identity theft and fraud. The CIP is mandated by the Patriot Act, which aims to combat money laundering, corruption, terrorism funding, and other illicit activities. For an individual to open a financial account, financial institutions must obtain the following personal information:

- Legal name

- Date of birth

- Complete address

- Legal identification number

Depending on the bank’s risk assessment, additional information may be required during the identity verification process. Institutions utilize various means, including government-issued identification cards and financial references, to verify customers’ identities thoroughly.

CDD is a critical factor in efficiently managing risks associated with potential clients. It involves assessing the trustworthiness of customers to shield businesses from dealing with individuals or entities engaging in illicit activities. Financial institutions employ different levels of CDD based on the risk posed by a customer:

- Simplified Due Diligence (SDD): Applied to clients with a low risk of criminal activities, SDD requires basic customer information without a detailed risk assessment. However, financial institutions must still keep a vigilant eye on the account for any suspicious activities.

- Basic Customer Due Diligence (BCDD): This level requires a more in-depth assessment of the customer, ensuring a comprehensive understanding of their background and potential risks.

- Enhanced Due Diligence (EDD): EDD involves expert analysis and close monitoring of high-value accounts or those displaying signs of unethical activities. Additional information is collected to gain deeper insights into the customer’s background and risks. It is the responsibility of banks to identify their risk exposure and ensure their customers are not bad actors.

Onboarding

KYC and identity verification play pivotal roles in client onboarding and fraud mitigation within various industries. When onboarding new clients, businesses must verify their identities to ensure they are legitimate and comply with regulatory requirements. Robust KYC procedures involve collecting and verifying essential customer information, such as name, address, and other identification data.

By doing so, companies can establish a trustworthy relationship with their customers from the outset, mitigating the risk of fraudulent activities and protecting themselves from potential legal and reputational consequences. Additionally, incorporating advanced identity verification technologies, like data-centric authentication and AI-powered algorithms, enables businesses to detect and prevent fraudulent attempts effectively. The combination of stringent KYC practices and identity verification measures not only fosters a secure and compliant onboarding process but also builds trust with customers, enhancing the overall customer experience and safeguarding the organization’s integrity in the face of evolving fraud threats.

Ongoing Monitoring

The importance of continuous monitoring cannot be overstated in an effective KYC program or the account management process. Simply conducting CIP and CDD checks is not enough to truly “know your customer.” To maintain the integrity of your business and stay vigilant against potential risks, ongoing monitoring of customer accounts is essential. This involves closely overseeing financial transactions and accounts based on predefined criteria to evaluate the customer’s risk profile. By doing so, businesses can proactively identify and address suspicious activities before they escalate into larger issues. To ensure comprehensive monitoring, consider the following factors in your risk mitigation plan:

- Significant Changes in Account Activity: Be alert to any unusual spikes or drops in transaction volumes, particularly if they deviate from the customer’s usual behavior or changes to their PII data. These changes could indicate potential illicit activities, fraud, or attempts to launder money.

- Sudden Changes in Business Operations: Keep an eye on any sudden and significant alterations in a customer’s business operations. Examples include changes in ownership, expansion into new markets, or increased involvement in cross-border transactions. Such changes may warrant further investigation to assess the associated risks.

- Law Enforcement Inquiries: Stay informed about any law enforcement inquiries or requests related to your customers. If a customer becomes subject to any legal scrutiny, it’s important to reassess the risks associated with their account.

- Adverse Media Mentions: Monitor news sources and other media outlets for any negative mentions of your customers. Adverse media can provide valuable insights into a customer’s reputation and potential involvement in illegal activities.

By implementing robust ongoing monitoring practices, organizations can enhance their KYC program’s effectiveness and better protect themselves from the risks of fraud, money laundering, terrorist financing, and other illicit activities. Remember, staying proactive in understanding your customers is the key to safeguarding your business from fines, sanctions, and reputational damage.

The KYC Evolution

KYC has evolved significantly over the years, branching out and overlapping with a broader concept known as identity verification. Initially, KYC practices were primarily implemented within the financial services sector to combat money laundering, fraud, and terrorist financing. However, with the rapid expansion of digital services and online interactions, the need for robust identity verification became apparent in various industries beyond finance.

KYC practices originated in the financial sector as a way to combat money laundering and fraud. But as more commerce moves online, identity verification has become crucial across industries. Companies need to validate customer identities in order to:

- Prevent fraud and digital crime.

- Adhere to regulations and compliance standards.

- Build trust by protecting customer data.

While biometric and document validation provides effective identity proofing, they can add friction by requiring deeper user engagement.

In contrast, Enformion uses AI/ML to entity-resolve identities from thousands of non-traditional alternate data sources and authoritative profile data, simplifying and streamlining the IDV process for users behind the scenes. It provides businesses with a flexible identity confirmation framework beyond Banking.

Final Thoughts

Today, KYC practices are non-negotiable. Not only for financial services, but for any business seeking to maintain trust, mitigate risk, and maintain regulatory compliance. Enformion’s IDV eSuite offers a revolutionary solution to streamline your KYC processes, ensuring robust identity verification, a seamless customer onboarding experience, and comprehensive risk management.

Safeguard your business from risks, build trust with your customers, and confidently navigate the dynamic financial landscape with Enformion’s transformative solutions. Embrace the future of KYC practices and embark on a journey of secure and efficient customer onboarding today!

Develop an Effective KYC Program Using Enformion’s eIDV Product Suite

Enformion’s IDV eSuite includes three powerful solutions: eIDV, ePrefill, and eIndicators. Each component is designed to address specific challenges and enhance your identity verification and KYC processes with greater accuracy, efficiency, and convenience.

eIDV is a proprietary Composite Score and risk indicator that verify identity data and provide a comprehensive view of an individual consumer.

ePrefill uses deep data and machine learning to quickly fill in missing consumer information, streamline customer onboarding, reduce friction, and provide accurate insights into consumer profiles.

eIndicators provide real-time solutions that utilize identity graph data and analytics to flag potential adverse risks, providing comprehensive insights into a customer’s background and aiding in fraud and risk reduction.