Building an effective compliance program is more complicated than ever, particularly when creating a digital know-your-customer built-to-scale. When implemented correctly, digital KYC solutions help to ensure regulatory compliance while also improving fraud detection results. However, failing to establish a working digital KYC program can leave your company open to increased expenses, weaker match rates, and lower conversion rates. These are all common examples of how a business may suffer when they are unable to keep up-to-date with regulation compliance.

Today, we will take an in-depth look into how real users gauge the importance of digital KYC in modern business, and explore areas of interest for how this can be used going forward.

What is Digital KYC?

Digital KYC refers to a set of due diligence practices that assist companies in preventing identity fraud, which can often be linked to other criminal activities, such as account fraud, human trafficking, terrorism financing, and money laundering.

Conducting KYC checks is essential to digital customer onboarding, acting as a first line of defense against bad actors and ensuring that businesses are doing their due diligence to prevent malicious activity. This highlights the primary goal of digital KYC – to establish a clear understanding of your customer base and foster a safer environment for businesses to operate in compliance with anti-money laundering (AML) laws.

Relying on electronic information-gathering methods, digital KYC leverages various channels and technologies to validate customer data. This can include online forms, biometric authentication, and document verification through secure online platforms. By collecting and authenticating pertinent information electronically, companies can build detailed profiles of their clients and ensure their information is accurate.

Popular Reasons For Using KYC

KYC strategies can be used for a multitude of reasons, however, their popularity almost always stems from their ability to establish valuable insights into large customer bases. Effectively, this gives companies an in-depth understanding of who their customers are. For example, if a new customer claims to be a specific person, who is a specific age, and lives in a specific area, it’s up to the company doing business with this customer to do their due diligence and make sure they are who they claim to be.

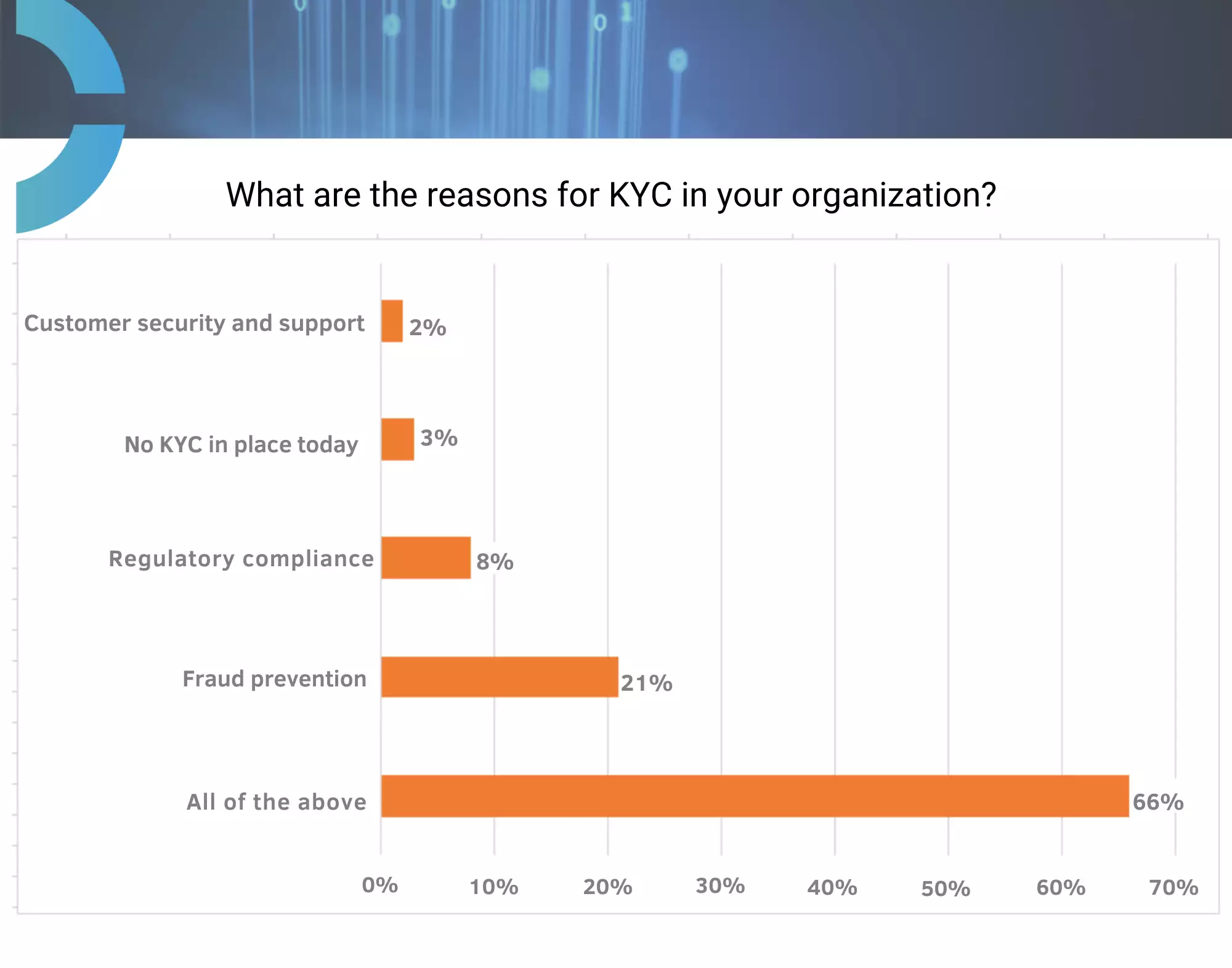

During a recently conducted Enformion survey, participants were asked to identify their key reasons for KYC implementation, with the majority using KYC for fraud prevention, regulatory compliance, and ensuring customer security. By implementing robust KYC processes, users can improve company-wide effectiveness in all of these areas of interest.

Regulatory Compliance: The Road Ahead

The current-day challenges of regulatory compliance are dynamic, as the field of customer authentication and company due diligence is steadily evolving into more and more complicated processes as time goes on. Initially, the Internet was meant to be operated anonymously, allowing consumers to access goods and services without any sort of vetting system to help companies understand who it was they were doing business with. In the years since then, however, many things have changed. Companies are now responsible for knowing their customer base, and making sure they stay compliant with local laws and regulations to continue to operate. Companies that offer goods and services that are age-restricted and region-specific need to be absolutely sure that the customers they sell to meet specific legal criteria before doing business. This can be anything from placing a bet in a state that does not allow it to purchasing alcohol online under the legal age, all of which needs to be regulated by the companies themselves. Of course, this information is not so readily available to authenticate and, quite frankly, can be very easily fabricated.

This is where digital KYC really shines, as it offers the necessary information for these companies to be able to authenticate their customer information and ensure they are acting in accordance with known regulations. However, this is just the beginning of a longer journey towards stricter and more in-depth online checks and balances. As we have seen since the start of the commercial embrace of online services and eCommerce, more and more regulations have been established, and stronger identification processes have been adopted to meet these new regulations. Following this trend, it’s clear that compliance with these new regulations will only become more intricate and difficult to adhere to as time goes on, and that getting ahead of it is essential to survive in an online marketplace. Embracing digital KYC today can help mitigate those challenges and better prepare companies for the increasing challenges they will face in the future of regulation compliance.

Understanding Demographic Challenges

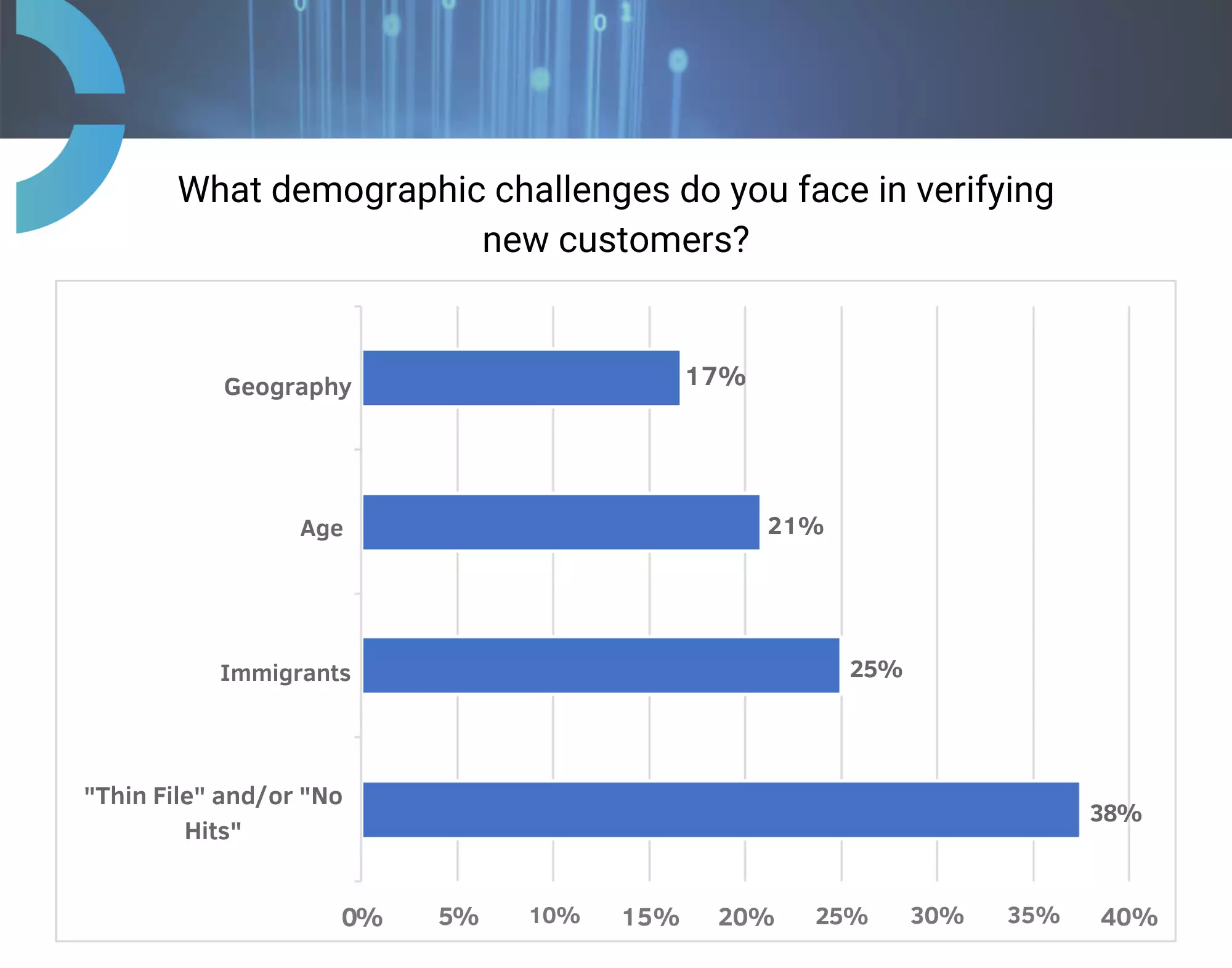

While digital KYC proves to be a formidable ally in regulation compliance, it still faces some significant challenges, especially when it comes to authenticating unknown customer information. Demographic challenges such as thin file populations, diverse customer ages, varying locations, and insufficient information on immigrant populations pose hurdles in the effective implementation of KYC processes.

To address these challenges, strategic approaches include leveraging alternative data sources, adaptive technology designed for different age groups, compliance adaptability to varying locations, and culturally sensitive verification methods for immigrant populations. By navigating these demographic challenges, businesses can enhance the effectiveness of their digital KYC processes, ensuring robust data collection and validation while providing a safer experience for a diverse customer base.

Thin Files, No Hits, And Lack Of Information

Delving deeper into demographic challenges, thin-file populations, no-hit scenarios, and the lack of information on immigrant populations further complicate the KYC landscape. These challenges underscore the need for innovative solutions that can adapt to diverse customer profiles and ensure accurate identity verification.

The challenge of thin file populations stems from individuals with limited or no credit history. According to Enformion’s recent survey, most people indicated that new customers with No-Hit/ Thin file records are the toughest challenge in KYC. Traditional KYC methods often struggle to establish a comprehensive understanding of their identity, posing difficulties in the verification process, especially for those new to financial systems.

For immigrant populations, the largest KYC obstacle lies in insufficient information, much like with thin file populations. Individuals who have recently moved to a new country may lack established credit histories or have limited documentation on record. The ability to accurately identify individuals from diverse cultural backgrounds becomes pivotal in ensuring the inclusivity and effectiveness of digital KYC.

Shifting Focus: Anti-Fraud Checks

Renowned for its role in helping companies with regulation compliance, digital KYC also shows off its capabilities through anti-fraud checks, introducing a critical layer of security into business operations. This strategic extension recognizes the insufficiency of information authentication alone in combating sophisticated fraudulent activities. The integration of anti-fraud checks signifies a proactive defense mechanism, fortifying businesses against the evolving landscape of potential threats online.

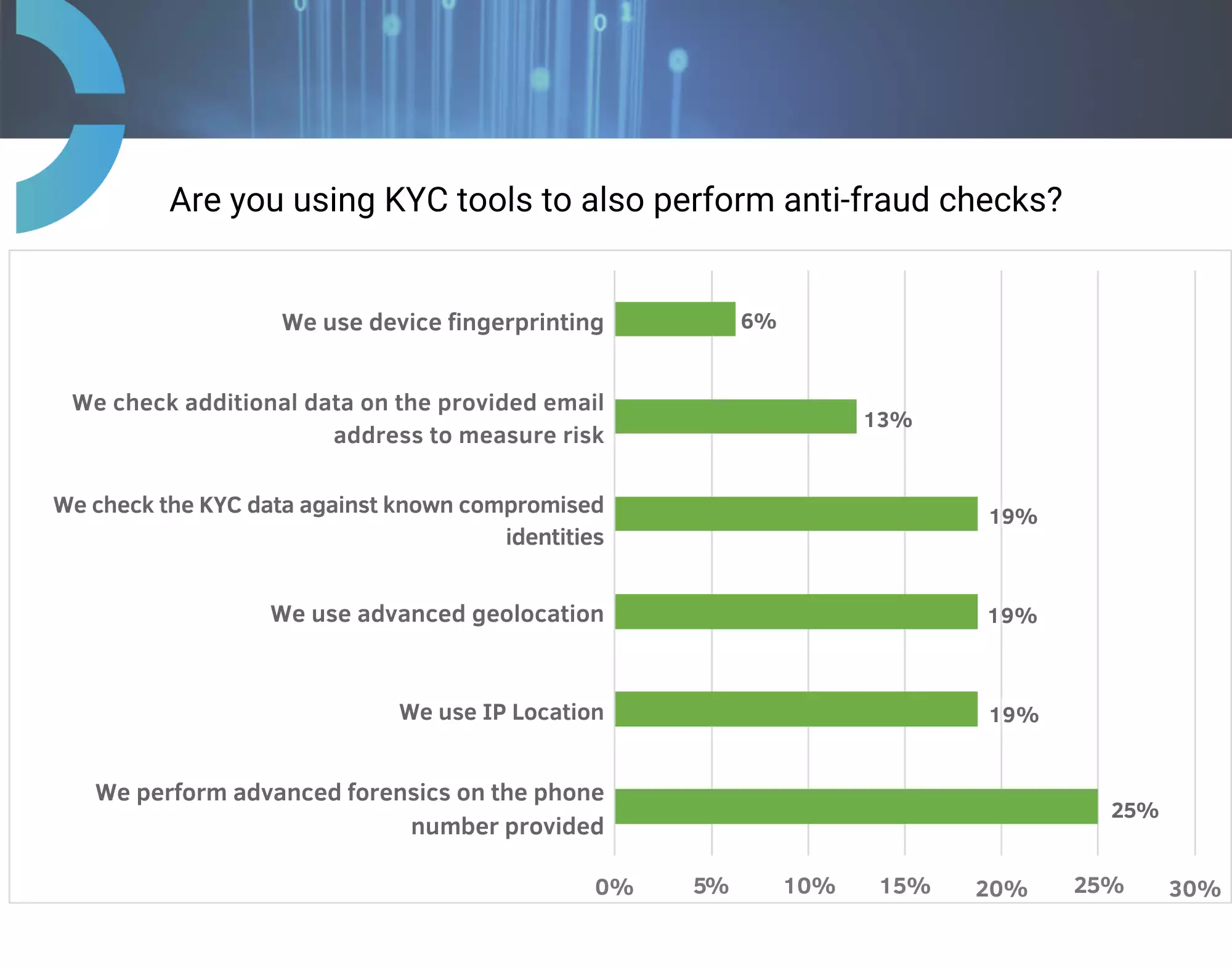

The effectiveness of anti-fraud checks lies in the strategic utilization of various data points. Businesses leverage a diverse set of information, including email addresses, geolocation, IP addresses, phone numbers, and examination of the user’s previous device history. This comprehensive approach contributes to the creation of a robust defense mechanism against fraudulent activities. The amalgamation of these data points not only serves to protect the interests of the business but also enhances customer security. For new customers undergoing onboarding processes, these checks ensure a secure and trustworthy environment, fostering confidence in the integrity of the business relationship.

What Information Is Used For Anti-Fraud Checks?

At the core of the effectiveness of anti-fraud checks lies the strategic utilization of multiple data points. A comprehensive approach rooted in cross-referencing validated customer information heavily strengthens established defense mechanisms used against fraudulent customer activity.

Going beyond data authentication and leveraging diverse data points can help businesses not only protect their interests but also prioritize the security and confidence of their customers. As many customer interactions online can be compromised, having these anti-fraud strategies in place will effectively create a safer and more trusted platform for your business to operate. Among the participants asked in Enformion’s recent survey, the most useful KYC resource for performing anti-fraud checks was provided phone numbers. With unique personalized information such as a phone number, extra steps can be easily taken to identify fraudulent activity and protect user information.

The Importance Of Digital Protection

The myriad of laws and regulations surrounding online business did not appear out of thin air, they are a response to the very real and increasingly intricate criminal activities taking advantage of companies who fail to protect themselves and their customers. One of the most commonly known examples of these regulations is the United States Patriot Act.

Introduced in 2001 as a response to the September 11th terrorist attacks, the US government established the Patriot Act to encourage companies to know more about their customers before granting loans, transferring money, or doing business in any way that could assist in criminal activity. This led to the requirement of financial institutions to comply with strict KYC rules, which include the Customer Identification Program (CIP) and Customer Due Diligence (CDD). However, just because these laws exist does not mean all companies follow them. There are hundreds of millions of dollars in fines handed out every year to companies that still do not properly adhere to these regulations. According to the United States Commodity Futures Trading Commission (CFTC), three founders of the company BitMEX were ordered to pay a total of $30 million in fines in 2022 after they failed to adhere to CFTC regulations and violated the Commodity Exchange Act (CEA). These violations could have been easily avoided through an effective digital KYC program, which would have helped save their company’s reputation, opened the doors for future business, and kept their wallets a bit heavier.

Optimizing KYC Strategies with Enformion Services

Whether a business operates on a small scale or is an industry giant, Enformion’s adaptability and depth of data ensure that a solution can be tailored to meet specific needs. Integration into existing systems is seamless, enabling businesses to optimize their KYC strategies without disrupting ongoing operations. Enformion services not only streamline information authentication but also provide solutions for the demographic challenges one might face, staying compliant with local laws and regulations, and strengthening defenses against fraudulent activities. As businesses strive to meet the demands of effective digital KYC strategy, leveraging Enformion’s capabilities represents a strategic investment in the optimization of these efforts, ensuring a secure and streamlined approach to the accuracy of your customer information.

Learn more about some of the products and services Enformion offers to optimize your digital KYC efforts:

- On-Demand Webinar: Digital KYC in 2024 & Beyond

- Fraud and Risk Mitigation

- eAgeComply – Age Verification

Final Thoughts

By verifying customer data, companies can create a trustworthy online environment, fostering both the confidence and loyalty of users. The transition to digital KYC represents more than just a technological upgrade, as it highlights a strategic shift in how businesses approach customer interactions. The advantages are multifaceted, encompassing operational efficiency, enhanced security, present and future regulatory compliance, and the ability to unlock valuable insights for the challenges of tomorrow.

To stay ahead in the game, adopting professional digital KYC services is a strategic imperative. It’s time to embrace the reinforcing power of digital KYC and bolster your company’s compliance ability and customer security through proven and effective authentication processes.